In 2016, the Gulf Cooperation Council (GCC) member states signed the Value Added Tax (VAT) agreement paving way for the introduction of the general levy on consumption across the region. The United Arabs Emirates (UAE) and Saudi Arabia became the first member states to adopt the treaty in 2018, and its implementation meant that for the first time businesses in these territories were required to file VAT returns periodically.

Nadim Alameddine, a UAE resident, says he immediately saw an opportunity in the accounting space as businesses sought to file returns as required by the new law. This insp

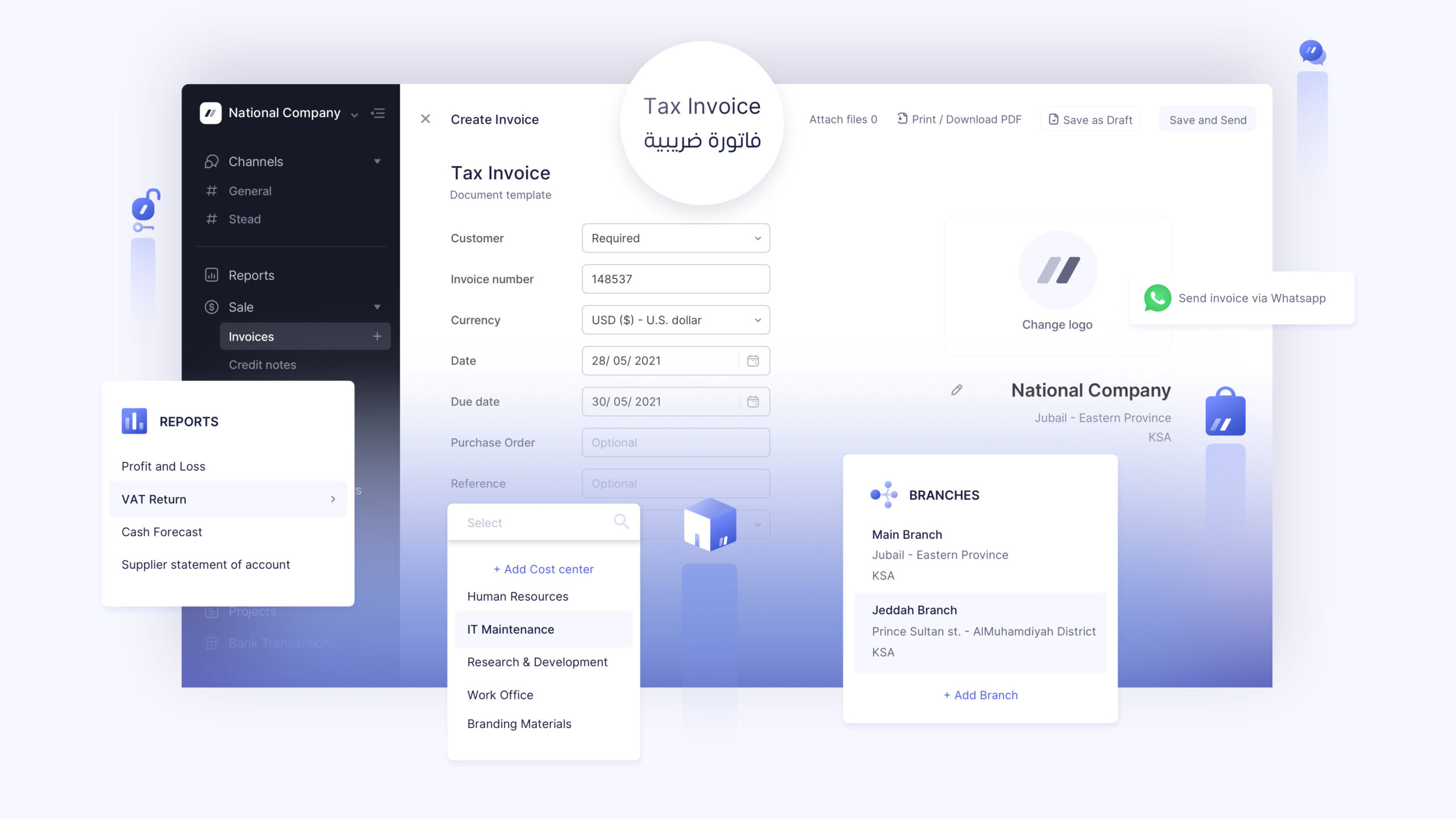

Dubai-based accounting and financial compliance startup, Wafeq, raises $3M

IT起業ニュース

IT起業ニュース

コメント